Introduction

The world of finance is undergoing a profound transformation with the advent of blockchain technology and decentralized finance (DeFi). One of the most exciting developments on the horizon is the tokenization of every major asset class. Enter Hifi, a pioneering platform that allows users to borrow against tokenized assets, ushering in a new era of liquidity and accessibility in the crypto space.

The Tokenization Revolution

From real estate to stocks, the tokenization of real-world assets (RWAs) represents a seismic shift in the way value is transferred and managed. This innovation is not just a trend; it’s a fundamental restructuring of the global financial landscape. By converting physical assets into digital tokens, Hifi is democratizing access to previously illiquid markets, unlocking trillions of dollars in value for investors worldwide.

Borrow Against Crypto Today

Hifi’s lending protocol empowers individuals to leverage their crypto holdings as collateral for loans. This functionality fills a crucial gap in the DeFi ecosystem, providing fixed-rate lending and borrowing solutions that are sorely needed. Whether you’re looking to unlock liquidity without selling your crypto assets or seeking capital for investment opportunities, Hifi offers a seamless and efficient borrowing experience.

Commercial Real Estate Collateral

Hifi has already made significant strides in the realm of asset-backed lending, with over $1 million in loans issued against commercial real estate collateral. This milestone is just the beginning of Hifi’s journey to unlock the value of RWAs through its innovative lending protocol.

The Final Frontier: Real World Assets

The tokenization of RWAs presents vast opportunities for traditional financial institutions and the burgeoning DeFi ecosystem alike. However, realizing this potential comes with its challenges. Hifi recognizes the complexities involved but remains steadfast in its mission to capture the trillion-dollar market opportunity presented by RWAs.

Introducing the RWA Framework

To streamline the onboarding process for RWAs, Hifi is introducing a new framework that simplifies governance and accelerates collateral adoption. Under this framework, governance approval of collateral rulesets enables Hifi to scale the onboarding of RWAs with minimal friction. By standardizing collateral requirements, Hifi ensures prudent lending practices and protects the interests of its decentralized autonomous organization (DAO).

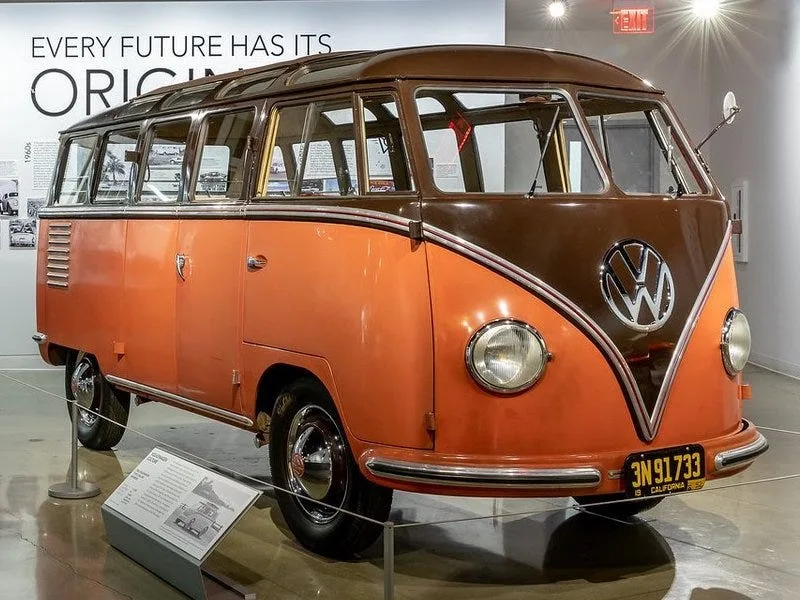

Example Ruleset: Vintage Vehicle Collateral

- Vintage: Vehicles must be manufactured over 25 years ago.

- Condition: Only vehicles in excellent or good condition qualify as collateral.

- Loan To Value (LTV): LTV ratios vary based on vehicle condition.

- Personal Guarantee: Borrowers may pledge personal assets to increase LTV.

- Valuation: Appraisal determines maximum loan amount.

- Loan Term: Maximum term is five years.

- Insurance Requirement: Comprehensive insurance coverage is mandatory.

- Documentation: Verification of title, appraisal, insurance, and borrower information is required.

- Loan Servicing: Lending partners manage loan servicing responsibilities.

On-Chain Implementation

Hifi is also enhancing its on-chain implementation to represent collateral more efficiently. Moving away from unique NFT collections, Hifi will deploy standard ERC-20 tokens to represent each collateral type. This streamlined approach improves scalability and usability within the protocol, paving the way for broader adoption of asset-backed lending on the blockchain.

Conclusion

With its innovative RWA framework and streamlined on-chain implementation, Hifi is poised to lead the charge in asset-backed lending within the crypto space. By harnessing the power of blockchain technology, Hifi is democratizing access to liquidity and unlocking unprecedented opportunities for investors worldwide. As the crypto ecosystem continues to evolve, Hifi remains committed to driving innovation and empowering individuals to realize their financial goals.

FAQ

1. How does Hifi differ from traditional lending platforms?

Hifi leverages blockchain technology to tokenize real-world assets, enabling users to borrow against a broader range of collateral with greater efficiency and transparency.

2. Can anyone borrow against their crypto holdings on Hifi?

Yes, Hifi’s lending protocol is open to anyone with crypto holdings, providing access to liquidity without the need to sell assets.

3. What are the benefits of tokenizing real-world assets?

Tokenization unlocks liquidity in previously illiquid markets, facilitates fractional ownership, and enhances transparency and security in asset transactions.

4. How does Hifi ensure the security of collateralized loans?

Hifi employs robust governance mechanisms and collateral rulesets to mitigate risk and protect the interests of its decentralized autonomous organization (DAO).

5. What’s next for Hifi?

Hifi is continuously innovating and expanding its lending protocol to onboard new collateral types and serve the evolving needs of the crypto community. Stay tuned for exciting updates and improvements!